We provide free but advertising supported comparsion service for different credit cards, the offers that appear on this site are from third party advertisers from which we receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). We do not guarantee to offer all financial services companies or products on this website.

Find Your Credit Card. Find Your Lifestyle.

Get StartedPopular Credit Cards of the Month

-

Macy's Credit Card -

Target Credit Card -

Sams Credit Card -

Lowe's Credit Card -

Milestone® Mastercard® - Bad Credit Considered -

Best Buy Credit Card -

Walmart Credit Card -

Victoria's Secret Angel Credit Card

What type of Credit Card are you looking for?

-

Store Credit Cards

-

Travel Credit Cards

-

Reward Credit Cards

-

Cash Back Credit Cards

-

Balance Transfer Credit Cards

-

Low Rate Credit Cards

-

Business Credit Cards

-

Student Credit Cards

-

Hotel Credit Cards

-

Secured Credit Cards

-

Shopping Online Expert

-

Airline Credit Cards

-

Airport Lounge Access

-

American Airlines AAdvantage® Aviator™ Silver Credit Card

-

Bed Bath&Beyond Credit Card

-

Best 0% APR Credit Cards

-

Best Business Credit Cards

-

Chevron and Texaco Credit Card

-

Co-Branded Airline Cards

-

Co-Branded Card

-

Co-Branded Store Credit Cards

-

Credit Card for No Credit

-

Diners Club Card Premier Credit Card

-

Everyday Spending

-

GameStop Power Up Rewards Credit Card

-

Gas and Groceries

-

Gas Credit Card

-

Long 0% Period

-

Meijer Credit Card

-

Menards

-

Milestone Mastercard

-

No Bank Account Required

-

PNC Credit Card

-

Rotating Reward Categories

-

State Farm Bank Credit Card

-

Student Credit Cards For Credit Card for International Students

-

SunTrust Credit Card

-

View More

Latest Credit Card Articles

-

Best Business Credit Card

July 19, 2025 -

Best Rewards Credit Card

July 19, 2025 -

Best Student Credit Card

July 19, 2025

Frequently Asked Questions

-

What is a student credit card?

Student credit cards are primarily marketed to school users who do not have a credit card of their own name. They can be a good way to solve the problem of "no credit history and no credit card".

Student credit cards allow you to borrow a certain amount of money each month. You can then choose to pay off the balance in full over a period of time (interest expense) or at the end of each billing period.

Student credit cards can help you get rewards and, in some cases, short-term interest-free financing. More importantly, the student credit card is the first step in establishing a good credit history, which is essential for getting a preferential interest rate on future loans, renting your own apartment and getting low insurance premiums. Some credit card issuers even offer special rewards to student cardholders who have achieved outstanding results in school.

-

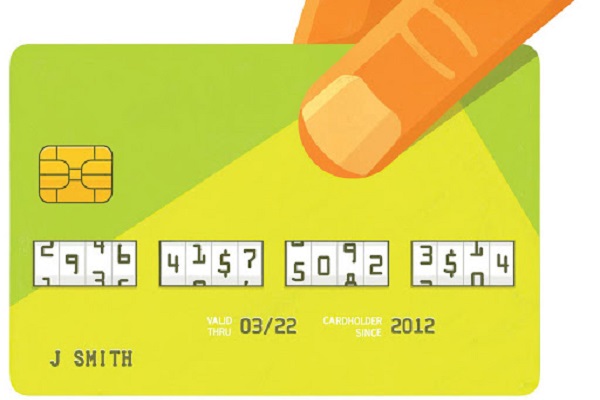

How to complete a balance transfer

When you respond to a balance transfer offer, you can indicate the account numbers you want to pay and how much you want to transfer.

After you get approved for the balance transfer, the new credit card issuer will contact your creditors or billers on your behalf and pay them the amount you want to transfer. This processing maybe takes up to two weeks.

If you have any payments due before that time, you have to make those payments by their due dates in order to avoid late fees.

You May Also Like

-

Macy's Credit Card

2 Cards -

Target Credit Card

1 Cards -

Sams Credit Card

1 Cards -

Lowe's Credit Card

4 Cards -

Milestone® Mastercard® - Bad Credit Considered

1 Cards -

Best Buy Credit Card

2 Cards -

Walmart Credit Card

2 Cards -

Victoria's Secret Angel Credit Card

1 Cards -

Old Navy Credit Card

4 Cards -

JCPenney Credit Card

2 Cards - All Credit Cards

About creditcardtw

About three-quarters of Americans have at least one credit card,In fact, the average person has 3.4 cards. But whether you have a wallet full of plastic or have never charged a purchase in your life, you should know how to apply for a credit card the right way when the time comes. getting approved for a credit card requires proactive planning that should start long before you apply. That's why creditcardtw born, we aim to help you to find the right credit card, and then successfully apply a credit card.

How To Apply For A Credit Card

Credit card applications are straightforward, but you'll need to meet some minimum financial requirements to get approved for the best credit card offers. Learn how to apply for a credit online and what to expect after you click submit.

- Knowing your credit score and what's on your credit report can help you determine what products to apply for. If you have fair credit, for example, you may not want to apply for a card that clearly states that only applicants with excellent credit will be approved.

- If you don't have good credit, you may find it difficult to get approved for a card with a large sign-up bonus and a lucrative reward structure. Each credit card application ends up on your credit report, so the Nerds recommend using our credit cards comparison tool to find a card that fits your credit profile before applying.

- If the card allows balance transfers, you may request to have balances transferred from other credit card accounts to the new card.

- To apply for a credit card in the US, you’ll need a valid Social Security number and a positive credit history. The best rewards credit cards may require at least three to five years of good credit history, and some more than seven.